Introduction

Financial transparency is the foundation of trust and credibility in any business. Whether you are a startup or a well-established company, having clear, accessible, and accurate financial records enhances decision-making and fosters stronger relationships with investors, customers, and stakeholders. In an era of digital transactions and stringent compliance requirements, improving financial transparency is not just an option—it’s a necessity.

Who Should Read This?

This blog is ideal for business owners, CFOs, financial managers, and entrepreneurs across industries looking to enhance their company’s financial clarity. Whether you run a small business or a large corporation, these strategies will help you strengthen financial reporting and compliance.

What This Blog Covers

This article will discuss key strategies for improving financial transparency, including clear financial reporting, the use of accounting software, proper compliance measures, and financial performance tracking. It will also highlight the importance of maintaining accurate financial records to optimize decision-making and build stakeholder confidence.

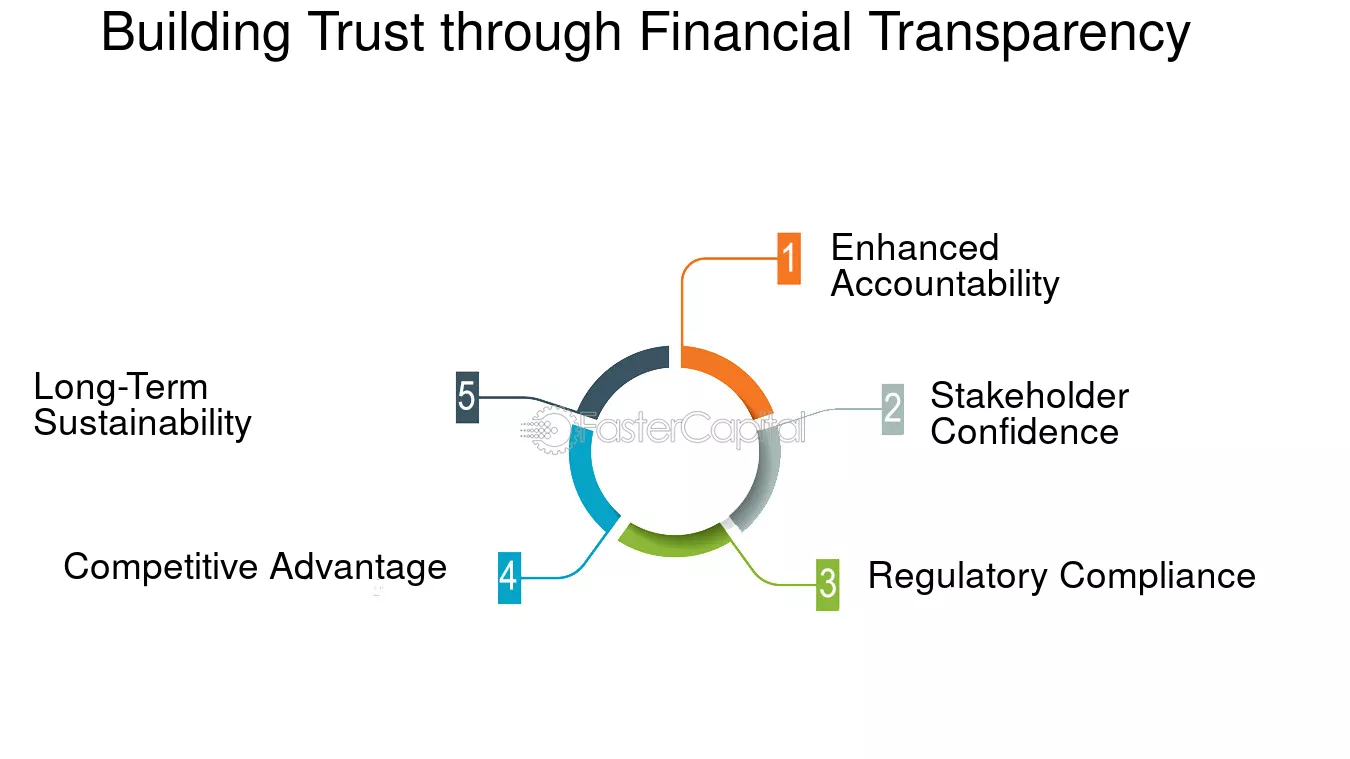

The Competitive Edge of Financial Transparency

Financial transparency means having clear and accurate financial records that stakeholders can access and understand. It helps in making informed business decisions, securing investments, and ensuring regulatory compliance. Lack of transparency can lead to financial mismanagement, loss of investor confidence, and potential legal consequences.

Financial transparency means having clear and accurate financial records that stakeholders can access and understand. It helps in making informed business decisions, securing investments, and ensuring regulatory compliance. Lack of transparency can lead to financial mismanagement, loss of investor confidence, and potential legal consequences.

Strategies to Improve Financial Transparency

-

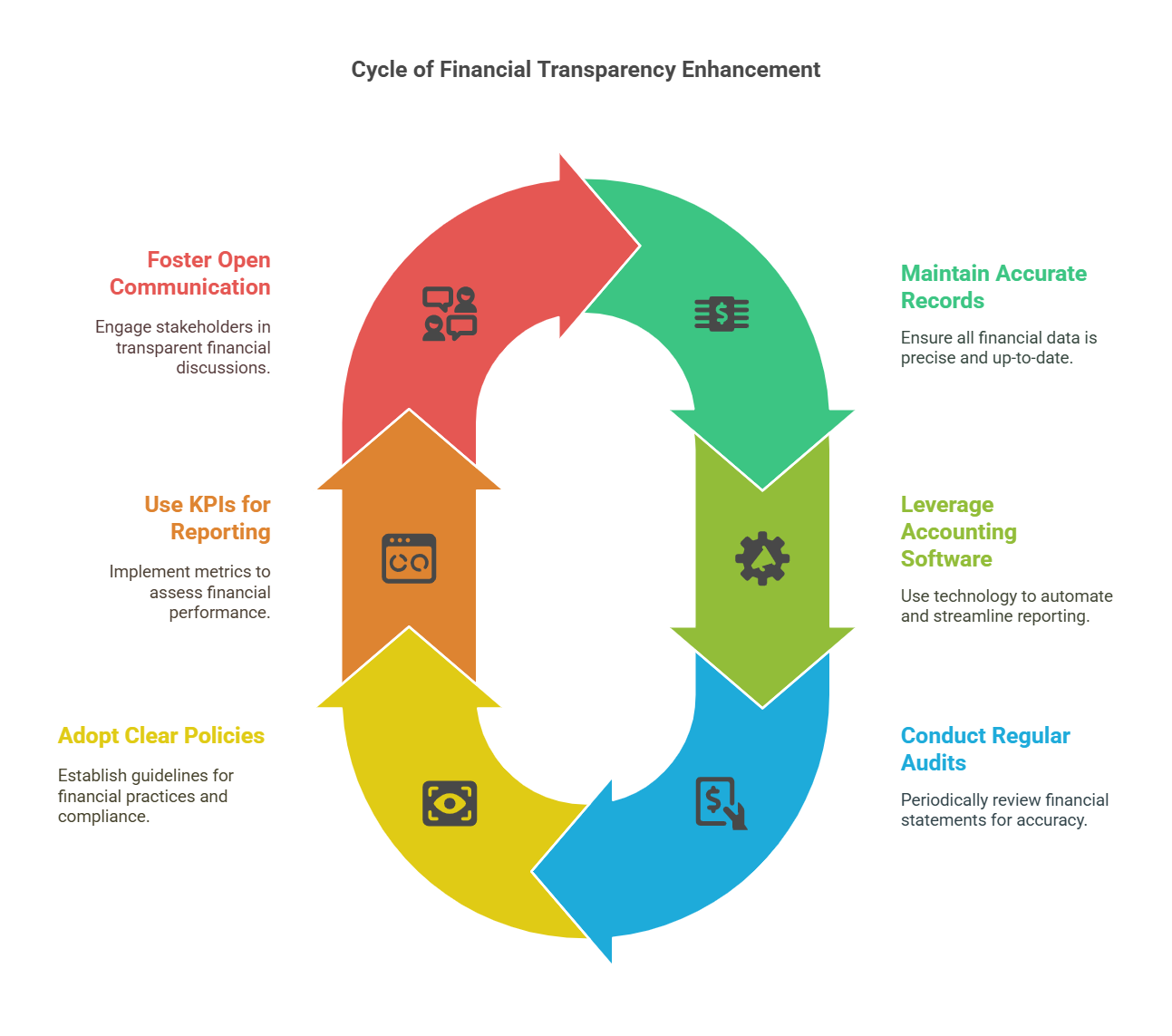

Maintain Accurate Financial Records

Ensuring that financial data is updated regularly is crucial. Businesses should implement strict bookkeeping practices and reconcile accounts frequently to avoid discrepancies. Using cloud-based accounting software can simplify record-keeping and minimize human errors.

-

Leverage Accounting Software for Automated Reporting

Automation plays a significant role in improving financial transparency. Using modern accounting tools can streamline financial reporting, generate real-time reports, and enhance data accuracy. Cloud-based solutions also allow for easy access and collaboration among financial teams.

-

Regularly Audit Financial Statements

Conducting internal and external audits ensures that your financial statements reflect an accurate picture of the business. Regular audits help identify discrepancies and reinforce compliance with financial regulations.

-

Adopt Clear Financial Policies and Compliance Measures

Businesses should establish clear financial policies, including spending limits, approval processes, and tax compliance measures. Educating employees on these policies will prevent financial mismanagement and foster a culture of accountability.

-

Improve Financial Reporting with Key Performance Indicators (KPIs)

Tracking essential financial KPIs such as profit margins, revenue growth, cash flow, and debt-to-equity ratio helps in assessing financial health. Transparency in sharing these metrics with stakeholders enhances trust and ensures better financial management.

-

Foster Open Communication with Stakeholders

Transparent financial reporting means openly sharing financial performance data with investors, employees, and customers. Providing quarterly or annual financial reports, along with clear insights, builds confidence and encourages long-term business relationships.

Conclusion

Unlocking business success starts with financial transparency. From securing investor trust to ensuring legal compliance and making better financial decisions, transparency plays a crucial role in long-term growth. By leveraging automation, conducting audits, and maintaining clear financial policies, businesses can achieve sustainable success and financial integrity.

Embrace financial transparency today to create a more accountable and resilient business environment!