Introduction

Artificial intelligence (AI) is revolutionizing financial management, reshaping traditional accounting methods, and introducing smart accounting tools. Businesses are increasingly adopting AI-powered accounting tools to streamline operations, enhance accuracy, and improve decision-making. AI bookkeeping software and AI-driven financial management solutions are becoming essential for modern businesses.

Audience and Industry

This article is designed for accountants, financial managers, small business owners, and finance professionals looking to understand the role of AI in business finance. The accounting industry is rapidly evolving, and AI automation in bookkeeping is becoming essential for improving efficiency and reducing errors. AI in financial management helps businesses stay ahead in a competitive landscape.

Overview

We will explore how AI-driven financial management enhances bookkeeping, automates transactions, and improves forecasting. We’ll also discuss the benefits of AI-based expense tracking software, compare AI vs traditional accounting software, and highlight the best AI tools for accountants.

The Role of AI in Accounting

AI in financial management enhances various accounting processes by leveraging machine learning and automation. AI bookkeeping software reduces manual data entry, detects discrepancies, and automates tax compliance. Automated accounting solutions enable real-time financial reporting and streamline budgeting and forecasting. AI-powered accounting tools provide increased accuracy and efficiency.

Click the picture

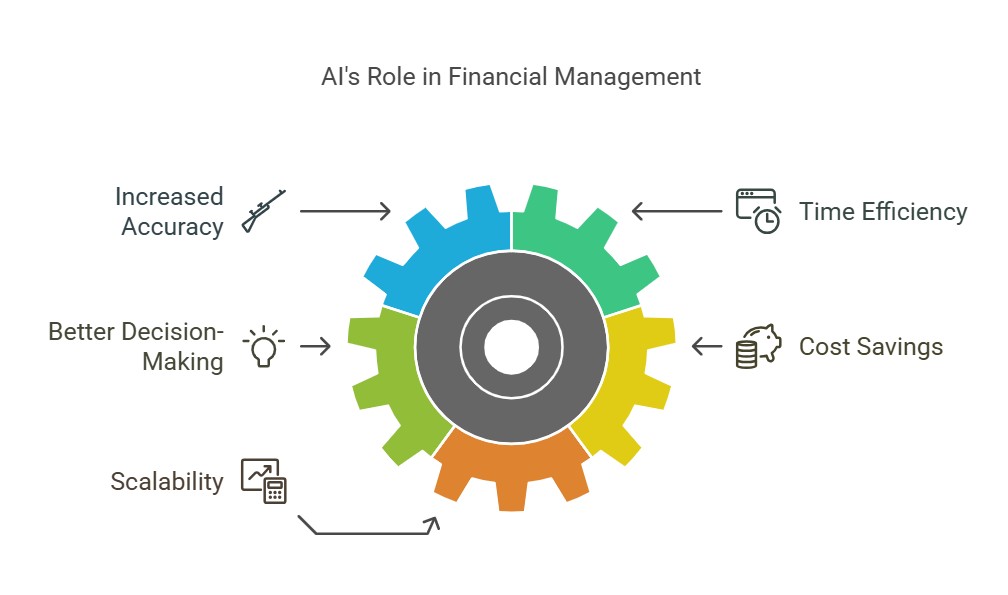

Benefits of AI in Financial Management

- Increased Accuracy – AI-powered accounting tools minimize human errors and improve financial report accuracy.

- Time Efficiency – Automated bookkeeping saves time by processing invoices, reconciling transactions, and generating reports.

- Better Decision-Making – AI-driven financial management provides real-time insights and predictive analytics for improved financial strategies.

- Cost Savings – Cost-saving AI accounting software reduces overhead expenses by minimizing manual labor and optimizing financial workflows.

- Scalability – AI for small business accounting allows businesses to scale without proportionally increasing administrative tasks.

AI vs Traditional Accounting Software

Traditional accounting software relies heavily on manual data entry and rule-based processing. Accountants must input transactions, categorize expenses, and reconcile accounts manually. This process is time-consuming, prone to human errors, and can lead to inefficiencies in financial management.

AI-driven accounting software, on the other hand, automates these repetitive tasks using machine learning and predictive analytics. AI can categorize transactions, detect anomalies, and process invoices automatically. This reduces human intervention, minimizes errors, and ensures compliance with financial regulations.

Additionally, AI enhances financial forecasting by analyzing historical data and identifying patterns that may not be apparent in traditional accounting. AI-powered solutions provide accountants with deeper insights and real-time financial analysis, allowing for proactive decision-making. In contrast, traditional accounting software requires manual data interpretation, which can lead to delayed and sometimes inaccurate forecasts.

Moreover, AI-based accounting software continuously learns from data inputs, improving its accuracy and efficiency over time. Traditional software, however, requires frequent manual updates and human oversight to stay relevant. AI also integrates seamlessly with other business tools, such as enterprise resource planning (ERP) systems and customer relationship management (CRM) platforms, further enhancing financial automation and connectivity.

Future of AI in Finance

The future of AI in finance lies in enhanced automation, AI-based expense tracking software, and predictive analytics. Businesses will leverage AI for accountants to gain deeper financial insights, reduce compliance risks, and improve overall efficiency. As AI technology evolves, financial professionals will focus more on strategy and decision-making rather than routine data entry.

Best AI Tools for Accountants

Several AI automations in bookkeeping tools are transforming the industry. Some of the best AI tools for accountants include:

- ClickUp – A cloud-based business management software that helps streamline financial processes, manage accounts, and generate reports with AI-powered assistance.

- Vic.ai – An AI-driven invoice processing tool that automates billing without requiring custom rules or templates.

- Bill – A cloud-based tool for automating accounts payable and accounts receivable, with integrated credit and expense management features.

- Indy – An AI workflow and admin tool designed for freelancers, offering contract creation, invoicing, and payment tracking features.

- Zeni – A finance and bookkeeping platform that combines AI with human expertise to automate expense tracking and provide real-time financial insights.

- Docyt – An AI-powered bookkeeping platform that ensures financial control through automated back-office processes.

- Gridlex – A unified suite of financial management tools that includes AI-powered expense management and ERP functions.

- Booke – A bookkeeping automation tool that leverages AI for real-time error detection and client communication.

- Blue Dot – A tax compliance platform that automates VAT calculations and employee-driven transaction analysis.

- Truewind – An AI-powered finance and bookkeeping platform designed for small businesses, providing monthly reports and expert financial support.

These tools help accountants improve efficiency, reduce errors, and enhance financial decision-making. With the right AI-powered accounting tools, professionals can automate repetitive tasks, optimize financial workflows, and focus on strategic financial planning.

Conclusion

AI is redefining accounting by improving efficiency, reducing errors, and enabling better financial decision-making. The integration of artificial intelligence in finance ensures businesses stay competitive, agile, and prepared for the future. As AI continues to advance, accountants and financial professionals must embrace these technologies to optimize their operations and drive growth. AI-powered accounting tools and AI-driven financial management are shaping the future of finance, making financial operations more efficient, accurate, and scalable.