Introduction

The accounting industry is evolving rapidly, with advancements in AI in accounting, cloud-based accounting, and blockchain in accounting shaping the future. These FinTech innovations are redefining how firms handle financial data, compliance, and decision-making. This article explores the top accounting trends for 2025, helping professionals stay ahead in an increasingly digital and automated world.

Who Should Read This?

This guide is for accounting professionals, CFOs, finance managers, and business owners who want to understand how emerging technologies and regulatory changes will impact their financial strategies. Whether you run an accounting firm or manage a company’s finances, these insights will help you prepare for the future.

What You’ll Learn

- The rise of AI-driven audits and robotic process automation (RPA) in accounting

- How blockchain technology is enhancing security and transparency

- The increasing reliance on cloud-based accounting solutions

- Key IFRS and GAAP compliance updates for 2025

- Cybersecurity and data privacy concerns in financial management

- The shift towards sustainability accounting and ESG reporting

Key Trends Reshaping Accounting in 2025

-

AI and Automation: The Backbone of Accounting Efficiency

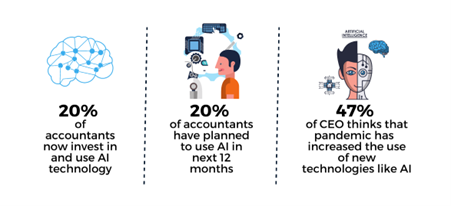

Artificial intelligence and machine learning in finance are transforming accounting workflows. AI-powered tools can automate data entry, financial reconciliation, and fraud detection, allowing accountants to focus on strategic advisory services. Predictive analytics for accountants are also becoming essential, enabling firms to anticipate financial trends and mitigate risks proactively.

-

Cloud-Based Accounting: The New Standard

The adoption of cloud ERP for accountants is accelerating, offering businesses real-time access to financial data, enhanced collaboration, and cost savings. Cloud solutions also support subscription-based accounting models, making financial management more flexible and scalable.

-

Blockchain: Reinventing Financial Security

Blockchain in accounting enhances transaction integrity and eliminates the need for intermediaries. This technology improves audit trails, financial reporting accuracy, and compliance automation, ensuring transparency in financial transactions.

-

Evolving Compliance Landscape: GAAP, IFRS, and Tax Regulations

Accounting standards continue to evolve, with IFRS updates 2025 and GAAP compliance 2025 introducing new reporting requirements. Tax law changes 2025 will also impact financial planning, necessitating proactive adjustments in accounting strategies.

-

ESG and Sustainability Accounting

With rising investor and regulatory focus on sustainability accounting, businesses must integrate ESG reporting regulations into their financial statements. Companies that prioritize sustainable finance will attract more investors and remain compliant with global standards.

-

Cybersecurity and Data Privacy

With increasing reliance on digital tools, cybersecurity in finance has become a top priority. Protecting sensitive financial data requires robust security measures, including multi-factor authentication, encryption, and compliance automation.

-

The Rise of Outsourced and Virtual CFO Services

Businesses are increasingly relying on outsourced accounting services and virtual CFO services to optimize financial management. These services provide access to expert financial insights without the overhead costs of maintaining an in-house team.

-

Accounting for E-Commerce and the Gig Economy

The gig economy and accounting are evolving together, requiring tailored financial solutions for freelancers and independent contractors. The gig economy refers to a labor market characterized by short-term contracts and freelance work rather than permanent jobs. With more professionals working as freelancers, accountants must address unique financial needs such as income variability, tax deductions, and retirement planning. Similarly, cryptocurrency taxation and e-commerce accounting demand specialized expertise to navigate digital asset regulations.

-

The Future of Accounting Jobs

Automation is reshaping traditional accounting roles. Instead of routine bookkeeping, accountants will focus on advisory services, compliance consulting, and financial strategy development. The need for tech-savvy professionals who understand RegTech (Regulatory Technology) and AI-driven tools will continue to grow. Read more

Conclusion

The digital transformation of accounting is inevitable, and firms that embrace new technologies will thrive in 2025 and beyond. By integrating AI, blockchain, cloud-based solutions, and advanced compliance automation, businesses can enhance efficiency, reduce errors, and make data-driven financial decisions.

Stay Ahead of the Curve

Accounting professionals must adapt, upskill, and leverage new technologies to remain competitive. Whether you’re a CFO, small business owner, or finance executive, staying informed about these trends will be crucial to navigating the evolving landscape of financial management.

Embracing these changes will not only improve operational efficiency but also enhance decision-making capabilities. Companies that fail to adapt may find themselves struggling to keep up with regulatory requirements and industry advancements. Proactively investing in training, technology, and strategic planning will ensure businesses stay resilient and competitive in the fast-evolving financial landscape.

Moreover, fostering a culture of innovation and continuous improvement will be key to thriving in the modern accounting world. Firms that leverage cutting-edge AI-driven analytics, blockchain security, and cloud-based financial solutions will position themselves as industry leaders.