Introduction

Introduction

In today’s competitive market, business finance plays a crucial role in driving growth and ensuring long-term success. From financial planning to business valuation, understanding the scope of business finance empowers businesses to make data-driven decisions, streamline operations, and stay competitive.

Audience and Industry

This blog is designed for small business owners, entrepreneurs, and professionals in the fields of business finance and marketing or business finance and accounting. Whether you are starting a new venture or managing an established business, mastering these concepts can significantly impact your financial performance.

What Will Be Covered

In this article, we’ll explore key financial strategies, tools, and techniques that every business should embrace for effective financial management. You’ll learn about financial analysis, business valuation, and the importance of using the best accounting tools to manage finances without hiring an accountant.

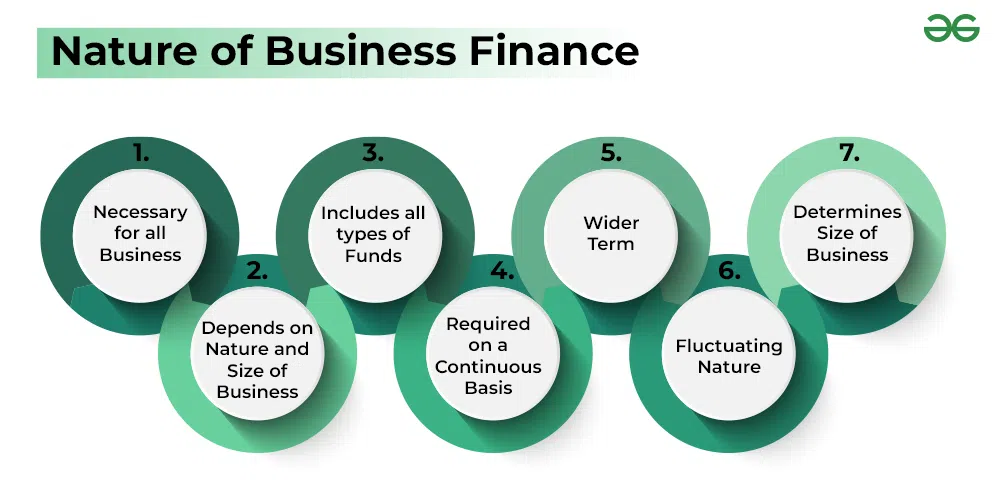

Understanding the Scope of Business Finance

Business finance encompasses everything from securing capital and managing cash flow to long-term financial planning. It’s not just about tracking revenue and expenses but also involves forecasting and making strategic decisions.

Financial analysis is at the core of business finance, enabling companies to assess their financial health. With proper analysis, businesses can identify growth opportunities and minimize risks.

Key Elements of Business Finance

- Financial Planning – Helps businesses set realistic financial goals and allocate resources efficiently.

- Cash Flow Management – Ensures a healthy balance between income and expenses to avoid financial bottlenecks.

- Business Valuation – Essential for attracting investors, mergers, and selling a business.

Strategies for Effective Financial Management

1. Leverage Accounting Tools

Using the best accounting tools is vital for modern business management. Tools like QuickBooks, Xero, and FreshBooks can help automate invoicing, expense tracking, and financial reporting. These tools simplify processes, reduce human errors, and offer real-time insights into your business’s financial performance.

MyBM is an all-in-one solution for business finance management, designed to streamline processes for businesses managing multiple accounts. MyBM helps businesses handle e-invoices, e-way bills, and offers a centralized hub for managing accounting tasks across multiple businesses. With MyBM, business owners can save time and focus on growth by automating key finance tasks and ensuring compliance with government regulations.

2. Focus on Financial Analysis

Performing regular financial analysis helps track profitability, liquidity, and operational efficiency. By analyzing key financial statements like income statements, balance sheets, and cash flow reports, business owners can make better decisions and address financial challenges proactively.

3. Develop a Financial Plan

A comprehensive financial plan acts as a roadmap for achieving business goals. It includes budgeting, setting performance benchmarks, and forecasting future income and expenses. Effective planning minimizes surprises and helps businesses adapt to market changes.

Extending Your Financial Knowledge

Financial management is not limited to tracking cash flow and profit margins. It also involves adopting risk management strategies to protect the company from unexpected financial downturns. Businesses can create contingency plans to prepare for market volatility and ensure they remain sustainable even during challenging times.

Using cloud-based business finance solutions is a game-changer for companies. Cloud accounting platforms such as Zoho Books, Sage, and Wave offer seamless integration with other business applications, enabling better collaboration and multi-user access. These tools help businesses manage financial operations remotely while ensuring data security and compliance with financial regulations.

Another crucial aspect of financial planning and analysis is business scalability. Entrepreneurs must regularly reassess their business model and financial strategies to ensure alignment with long-term objectives. Evaluating business valuation regularly helps attract potential investors and opens doors to expansion opportunities.

Monitoring and Refining Strategies

Constantly monitoring financial reports and refining strategies based on the insights gained can significantly improve business performance. By identifying seasonal trends, analyzing key metrics, and understanding cost structures, companies can make proactive decisions.

Additionally, businesses should aim to optimize their pricing strategies. Financial analysis of profit margins can reveal areas for adjustment, allowing companies to maintain competitiveness without sacrificing profitability. Incorporating financial planning tools can also streamline these processes and increase efficiency.

Staying up-to-date with the latest trends in business finance and accounting is essential. Attending finance webinars, reading relevant industry articles, and networking with professionals in the field will ensure business owners remain informed and prepared for future challenges.

Conclusion

Mastering business finance is crucial for any organization aiming for sustainable growth. By focusing on financial planning, leveraging the best accounting tools, and conducting regular financial analysis, you can ensure your business stays financially healthy. Implement these strategies to manage your finances like a pro and take your business to new heights.

If you want to know about Small Business Budgeting

Read Here